Going public in the US is now on the fast track! How can you seize policy benefits and market opportunities?

04/03/2024

As global capital markets refocus their attention on Chinese ADRs, a subtle policy shift is reshaping the landscape for Chinese companies seeking to list in the US. The strong signal sent by the China Securities Regulatory Commission (CSRC) in early spring 2025 not only paves the way for companies to access Wall Street via a "fast track," but also ushers in strategic-level innovation in the financing ecosystem.

I. Policy Update

The three major breakthroughs announced at the CSRC Party Committee meeting on March 11 directly address long-standing pain points for cross-border listings by companies and pave the way for high-quality companies to access international financing channels more smoothly.

The China Securities Regulatory Commission (CSRC) has adopted the "customs clearance" concept to establish a three-color channel system—red, yellow, and green—based on industry characteristics, corporate qualifications, and risk levels. The green channel is applicable to companies with strong innovation attributes and good compliance records, enabling "submit and review immediately" for filing materials, with a processing time reduced by over 40%. The yellow channel targets companies with minor compliance issues but sound business operations, implementing targeted inquiries on key issues. The red channel is for companies handling sensitive data or subject to special regulatory requirements, requiring joint reviews by multiple departments. Companies are permitted to flexibly adopt 18 innovative financing tools such as SPAC mergers and convertible bonds after listing, with the process for introducing strategic investors shortened to 15 working days. A "sandbox regulation" pilot program has been launched, allowing companies to conduct compliance stress tests in specific areas such as data security.

II. Efficiency Revolution

Automatically extract key data from prospectuses, with risk identification accuracy improved to 92%. Eight departments, including foreign exchange management and data security, have implemented a "one-stop service" system. A regular communication mechanism has been established with the PCAOB, and the efficiency of resolving audit working paper disputes has improved threefold.

III. New Financing Situation

Allow high-quality Chinese-listed companies to launch small-scale additional share issuances on a quarterly basis, with a single financing scale not exceeding 5% of market capitalization, thereby exempting them from certain review procedures. Clarify exit paths for private equity (PE) and venture capital (VC) investors, and establish dedicated channels for sovereign wealth funds and ESG investors. Pilot a "dual listing" mechanism between Hong Kong and US stocks, and connect offshore RMB funds exceeding 200 billion yuan.

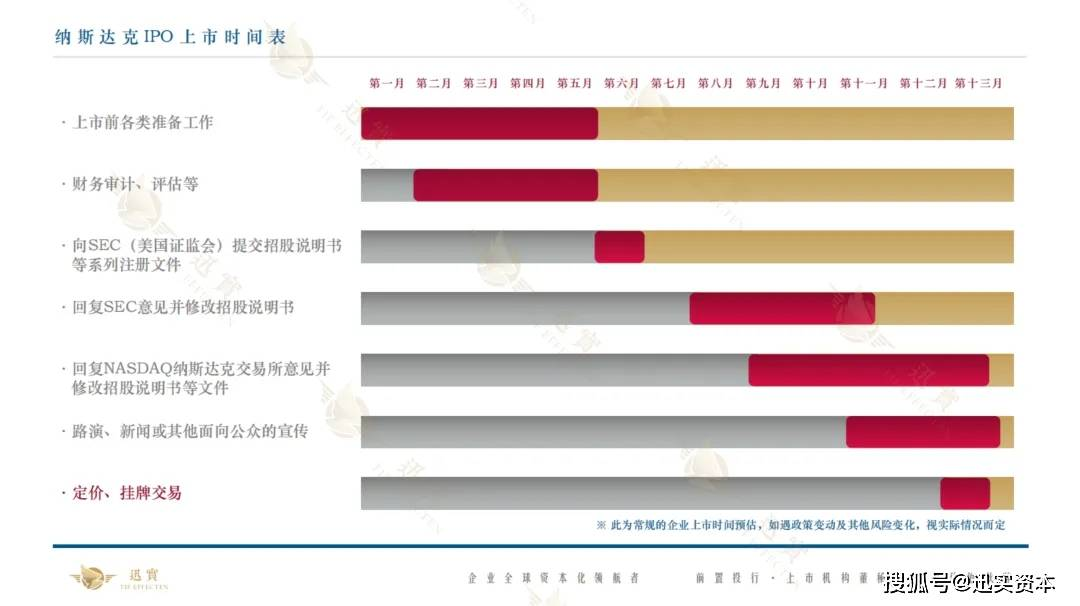

IV. US Stock Listing Process and Advantages

(1) NASDAQ listing requirements

图片来源:迅实内部资料

Chinese companies listing on NASDAQ not only gain access to financing but also enhance their international visibility. Listing on NASDAQ provides a platform for companies to engage in international and domestic cooperation. NASDAQ offers a range of value-added services to listed companies, with the most significant being the ease of subsequent financing. NASDAQ places no time restrictions on subsequent financing, with the fastest turnaround time for a secondary offering being as short as six months.

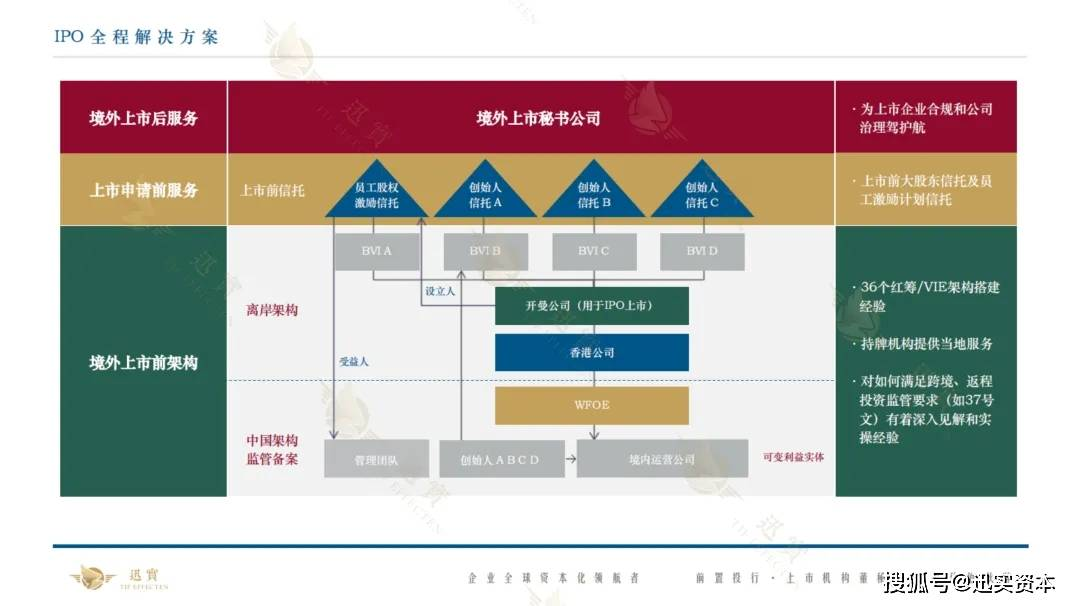

图片来源:迅实国际

Domestic companies listing overseas not only provide foreign companies with an information platform to understand domestic companies, but also create a good start for domestic companies to enter overseas capital markets. By listing overseas, companies implicitly enhance their overseas reputation, which is conducive to expanding international markets and obtaining preferential credit and services in foreign trade, thereby creating favorable conditions for the comprehensive development of companies.

(2) Advantages of listing on NASDAQ

The United States boasts active financial markets, including foreign exchange markets, stock markets, futures trading, and securities markets. The NASDAQ is the largest stock exchange in the United States in terms of the number of listed companies and trading volume, with approximately 5,400 companies listed. NASDAQ-listed companies span all high-tech industries, including software, computers, telecommunications, biotechnology, retail, and wholesale trade. As of May 13, 2024, there were 16,786 companies listed in the United States, with a total market capitalization of $59 trillion and a total outstanding share count of 5.77 billion shares.

Image source: Xunshi International

A total of 162 companies completed IPOs in the US, raising a total of US$119.6 billion, or RMB 843.675 billion. As of May 10, 2024, a total of 162 Chinese companies were listed in the US, with a total market capitalization of US$1,743.646 billion. In terms of listing markets, 133 companies were listed on the Nasdaq Stock Exchange and 29 companies were listed on the New York Stock Exchange.

[Source: Sohu.com · Xunshi Capital]

25 March 2025

https://business.sohu.com/a/875658323_120099153

扫码关注公众号